MASH

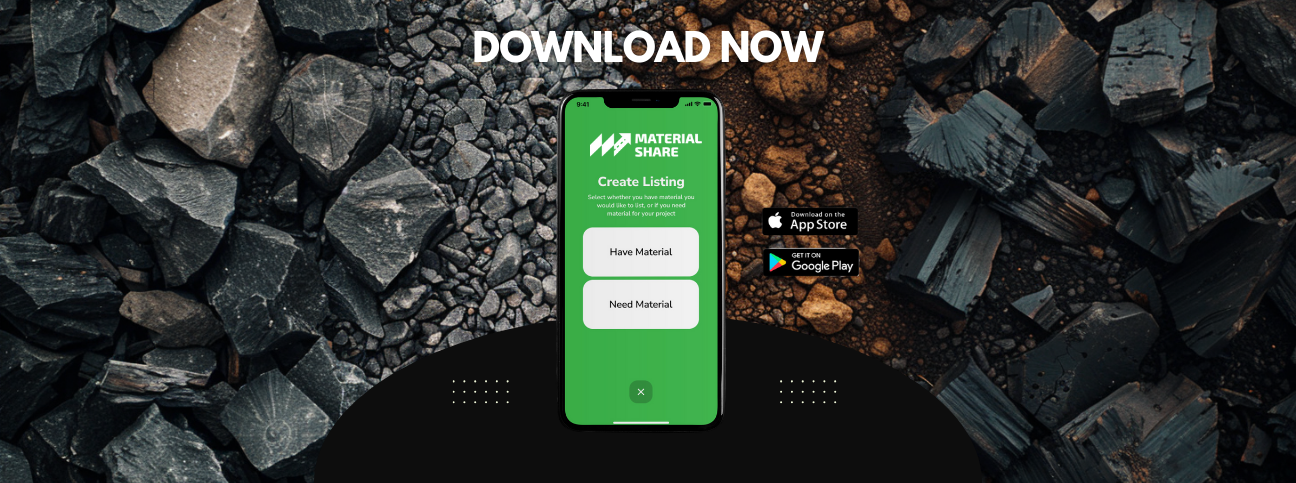

Material Share is a tech-driven logistics and marketplace platform revolutionizing the $250B+ U.S. construction materials and trucking industry. We connect contractors, suppliers, and independent truckers in real-time through a streamlined app that simplifies material sourcing, hauling, and invoicing. Our mobile-first platform enables instant listings, automated matching, referral rewards, and soon, full-service dispatch, ticketing, and billing capabilities.

With over 400 early adopters, our MVP is already live and gaining traction. The platform was built from the ground up by industry insiders and is designed to serve the full lifecycle of a construction logistics job—from material need, to hauling, to digital ticketing, invoicing and payment tracking. Unlike traditional marketplaces, Material Share is vertically integrated and designed to scale quickly through smart onboarding, geofenced automation, and user-friendly subscription models.

This offering gives investors tokenized equity in the company, allowing for fractional ownership and direct upside participation. The funds raised will go toward completing advanced development phases (including AI automation, digital ticketing, and time-tracking features), and executing a multi-channel marketing campaign targeting thousands of underserved contractors and truckers.

By leveraging tokenization, Material Share is offering modern investors a more flexible and accessible stake in one of the most overlooked industries in tech. This is your chance to own part of the infrastructure that will digitize construction logistics from the ground up.

Visit the Material Share Data Room:

Project Website

Learn more here

Overview

Material Share, LLC is a Delaware limited liability company issuing a tokenized equity offering structured as 500 membership interest tokens (each priced at $1,000), representing 11.11% of the fully diluted capitalization of the company on a pre-money valuation of $4 million. The offering is governed by the Company’s Operating Agreement and the terms of the Private Placement Memorandum (PPM), and is intended for qualified accredited investors under Rule 506(c) of Regulation D. Each token corresponds to one unit of ownership interest in Material Share, LLC and is managed on a compliant smart contract system that provides traceable ownership and readiness for digital cap table management or future secondary market participation (subject to applicable securities laws).

The asset underlying this offering is Material Share’s integrated construction logistics platform and its associated digital infrastructure. The business combines software-as-a-service (SaaS) with marketplace technology for the $200+ billion construction materials and hauling market in the U.S. The core value of the company lies in its dual-sided B2B marketplace that facilitates the listing, searching, and scheduling of construction materials and trucking services, with a focus on eliminating logistical inefficiencies, reducing waste, and accelerating procurement timelines for builders, haulers, and contractors.

The current live platform includes web and mobile components that support verified listings for trucks and materials, a referral system, matching functions for material needs, and user account management. While MVP traction has already been demonstrated, the platform is actively developing more advanced features in three phased stages:

Phase 1: Core trucking job listings, dispatch flow, geofenced site generation, basic billing logic, truck calendars, UX optimization, and digital invoice architecture.

Phase 2: Digital ticketing, truck time tracking, dual signature capture (driver and contractor), consolidated invoicing, ledger and audit trails, and job costing modules.

Phase 3: Geofenced automation for load-cycle detection, an AI-driven voice assistant, analytics dashboards, billing roll-ups, and regulatory compliance tooling.

The company's business model is designed for high scalability and includes multiple revenue streams: subscription tiers for users, premium boost listing fees, Uber-like dispatch options for truckers, and planned transaction commissions. Material Share’s backend is modular and built to integrate third-party logistics tools, document handling, and CRM functions over time.

This offering provides early investors with direct equity participation in a technology-enabled infrastructure company targeting an enormous, fragmented, and under-digitized market. By using blockchain for cap table automation (not utility or speculative tokens), the company offers a legally compliant and operationally efficient equity distribution framework. Investors receive economic rights including potential future profit distributions and dilution protection mechanisms as detailed in the PPM and operating agreement.

Visit the Material Share Data Room:

About Us

Roy Keate – Founder & CEO, Material Share

Roy Keate is a seasoned entrepreneur, investor, and innovator with over a decade of experience in the construction, fintech, and blockchain sectors. In 2014, he founded Tycoon Construction, a civil construction company specializing in commercial and residential infrastructure. Under his leadership, the company grew from a single-person operation to a $2–$3 million annual revenue business with over 30 employees.

Drawing on this deep industry expertise, Roy launched Material Share, a construction technology platform designed to solve inefficiencies in material sourcing and trucking logistics. With his background in operations and field logistics, Roy recognized the fragmentation and waste in the construction supply chain and set out to build a scalable solution that integrates listings, real-time matching, and automated billing. The company is currently in its early traction stage, with a live MVP, 400+ users, and a growing pipeline of feature development that includes digital ticketing, automated billing, and AI-based dispatch optimization.

Roy also has a strong background in Web3 and tokenized ecosystems. He has served as a crypto consultant and educator for nearly a decade and holds a U.S. patent for a proprietary construction tool. His strategic focus blends traditional industry knowledge with emerging technologies to create scalable, investor-aligned platforms aimed at transforming legacy industries.